IndyAcademy

How to value a public company/stock

How to value a public company/stock

Couldn't load pickup availability

Recommended Prerequisite: Stock Market Basics

Stock Valuation Self-Study Course

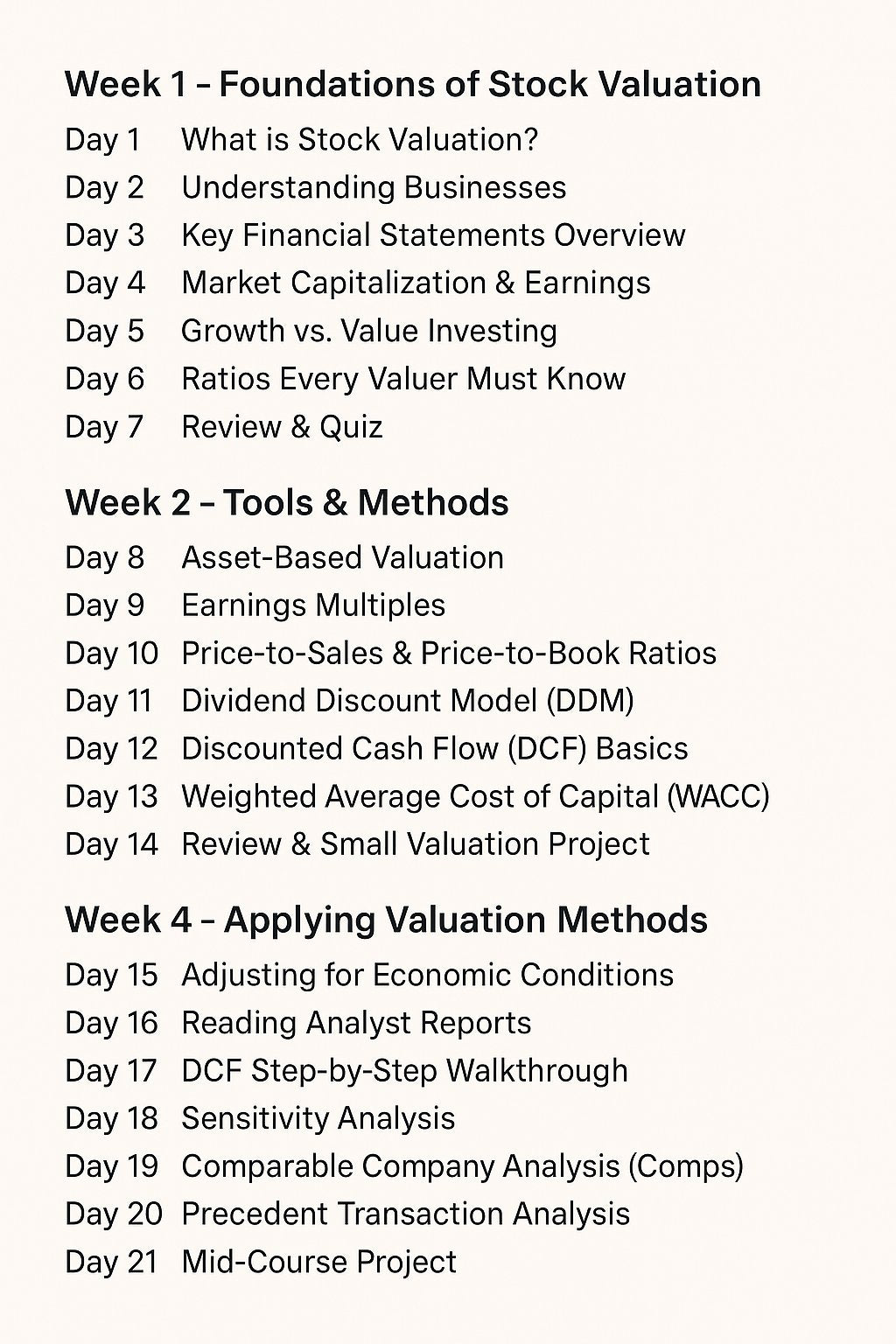

A complete 30-day, step-by-step program designed to teach you how to analyze and value a stock from scratch — using Apple Inc. (AAPL) as a real-world example. You’ll start with the basics of intrinsic value, financial statements, and key ratios, then progress through all major valuation methods including P/E, PEG, P/S, P/B, Dividend Discount Model (DDM), and Discounted Cash Flow (DCF).

By the end of the course, you’ll have:

-

A full professional-grade DCF valuation model

-

An understanding of economic factors, risk analysis, and margin of safety

-

A completed investment thesis and valuation report

-

The confidence to apply these methods to any publicly traded company

Share